Financials config

Kevin O'Brien (Unlicensed)

Kasia Czwarkiel (Unlicensed)

This is where all system financial settings can be configured.

Invoicing

Supplier Invoices

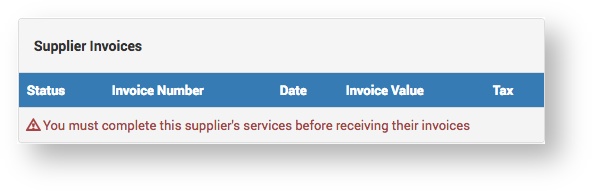

If this option isn't selected, when you get to the Invoicing step of a Project Part, you will see this message under Supplier Invoices and have to go back to the Supplier PO tab and click Project Completed.

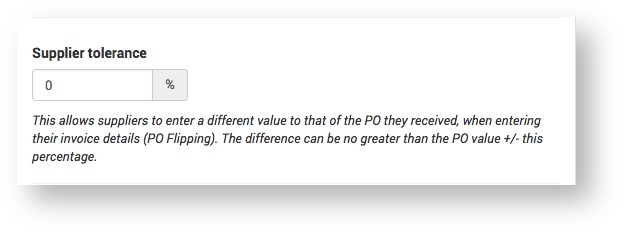

In the context of a Supplier, 'Invoicing Tolerance' is the percentage below the value of their PO that the Supplier can charge.

When the Supplier's invoice is received by the system, any variance between the PO value and the invoice value is automatically added to the Project as an 'Extra' to ensure the costs balance exactly.

The percentage tolerance is usually small and is primarily used to enable the Supplier to invoice allowing for rounding differences (particularly relevant where there is a high volume of invoicing).

An 'Invoicing Tolerance' of 0% would ensure that the Supplier is only ever able to submit their invoice for a value identical to the PO. If the Supplier wished to submit a different value they would have to submit a manual invoice in the traditional manner.

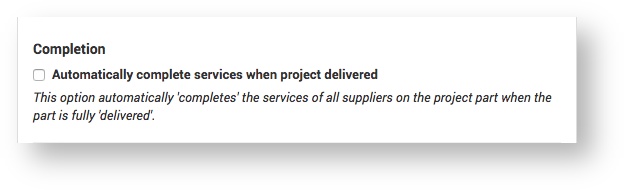

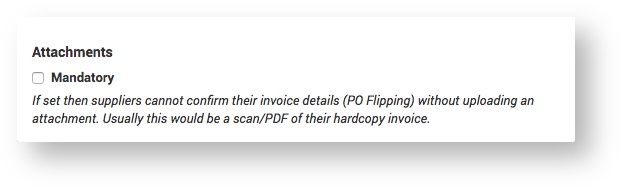

This option is fully described in the GUI note above.

Customer Invoices

This option allows the Service Provider to create a consolidated Customer invoice including all of the Project Parts for a particular period (for example, a month or a quarter).

A consolidated invoice can be processed in exactly the same way as an individual invoice (for example, approving and issuing the invoice).

If this option is selected, product unit prices will be shown on the Customer Invoice PDF.

The unit price is the price per unit of stock (i.e. product stored in a warehouse).

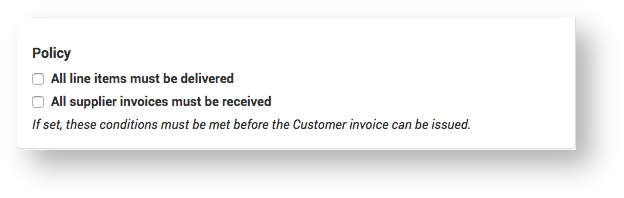

This option is fully described in the GUI note above.

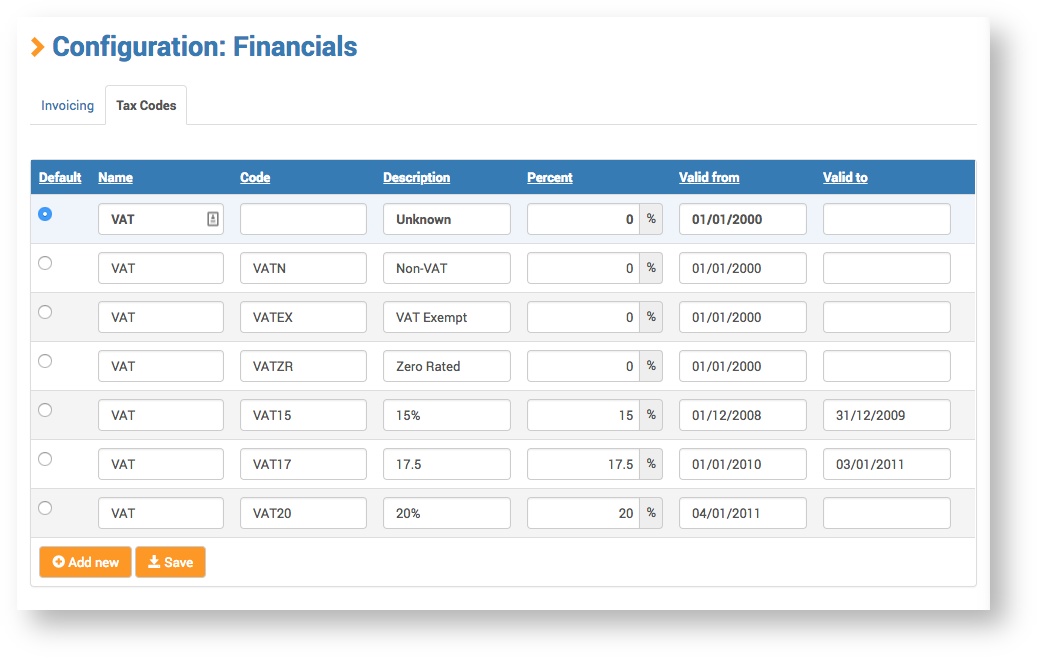

Tax Codes

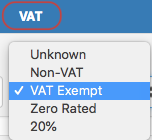

The Service Provider can create different Tax Codes which can be applied when working with Projects and Customer Invoices.

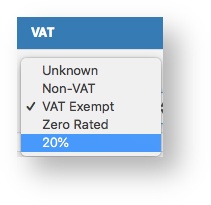

Multiple Tax Codes can be configured. Once configured they will be available on the Projects and Customer Invoice pages as a drop-down menu:

| Field | Description |

|---|---|

| Default | Select the Tax Code that you want to be the default for all Projects and Sales Invoices. The default setting does not fix the Tax Code, it can be changed on a Project or Sales Invoice as required. Only one Tax Code can be the default. |

| Name | This is the type of tax (for example, VAT) and is the column heading of the tax code list when processing a Sales Invoice.

|

| Code | This is the Tax Code prefix (for example, VAT20) |

| Description | This should be a short description to make the Tax Code easy for the Administrator to identify (for example, VAT Exempt). |

| Percent | This is the tax percentage value (for example '20' if the VAT percentage is 20%). |

| Valid from | This is the date you want the tax code to be valid from. |

| Valid to | This is the date after which the tax code will not be available (it will disappear from the list of selectable codes on Project and Sales Invoices). If the field is left blank the tax code will not expire. |

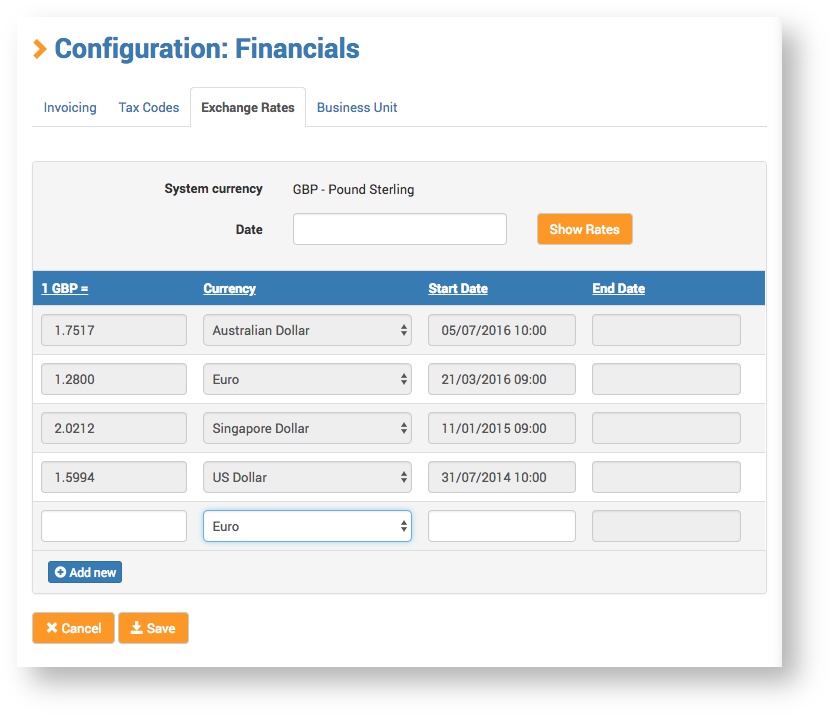

Exchange Rates

This is where the Service Provider can configure exchange rates from GBP to another currency. When configuring a Customer or Supplier in the system, the Service Provider sets the currency used in their view of the system, and the exchange rate set here applies to that currency. (See Customers and Suppliers for details on how they are configured).

Create a new exchange rate:

- Click the Add New button.

- Select a currency from the Currency drop-down list.

- Enter the exchange rate.

- Select a Start Date and End Date.

- Click the Save button.

Update an existing exchange rate:

Generally speaking, updating the currency is based on adding a new exchange rate to the system instead of editing the existing one.

- Click the Add New button

- Select a currency from the Currency drop-down list

- Enter the future exchange rate

- Select a Start Date and End Date

- Click the Save button

If you update the currency with a future Start Date then this new currency will show on the system starting from that date.

System exchange rates set here are 'hard coded' and are not updated automatically. Therefore it is very important for the Administrator to keep them up-to-date for Customers and Suppliers.

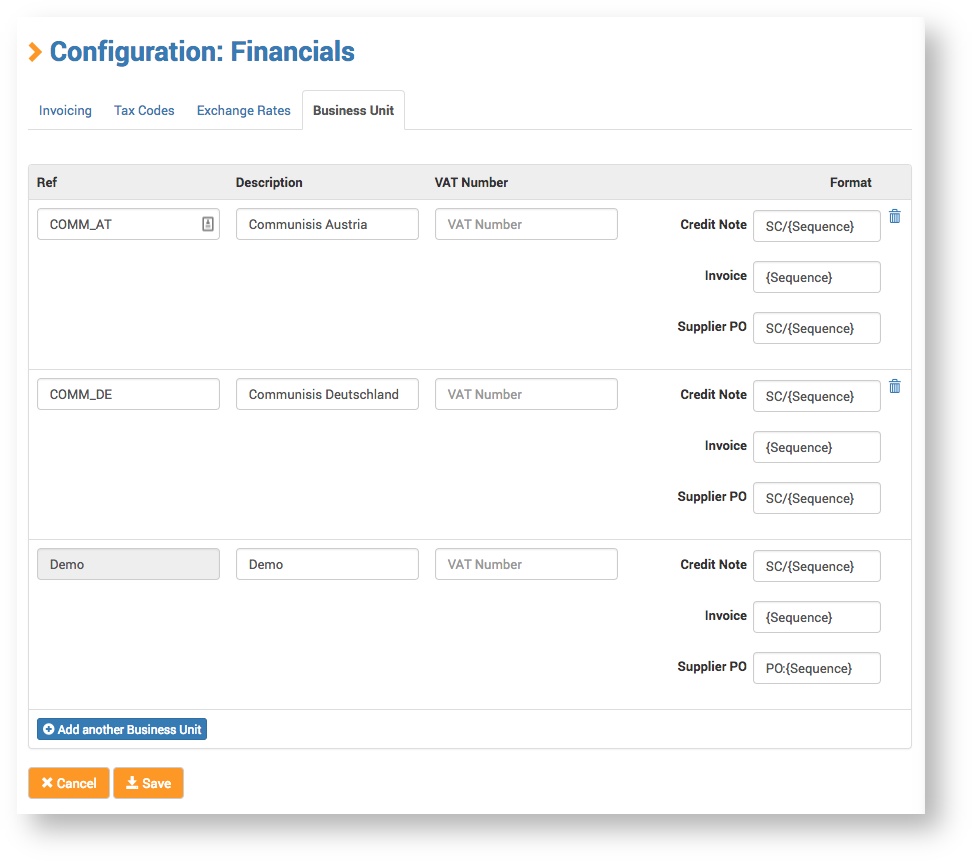

Business Unit

A Service Provider organisation may be split into different Business Units (also known as departments, divisions or functional areas). If so, the Service Provider can configure different Business Units here that can then be assigned to administer different Customers. This is done when configuring Customer details (see Customers).

Create a new Business Unit:

- Click the Add another Business Unit button.

- Enter the Ref (reference), Description and VAT Number for the Business Unit.

- Enter the text {Sequence} in the Credit Note, Invoice and Supplier PO fields.

- Enter a prefix for the Credit Note, Invoice and Supplier PO as required (for example, the 'PO:' prefix for Supplier PO numbers).

- Click the Save button.

{sequence}

The text {Sequence} must be entered in the Credit Note, Invoice and Supplier PO fields as it maps to the Credit Note, Invoice and Supplier PO numbers in the system database. If {Sequence} is not entered in the field, a number will not be generated when processing a Credit Note, Invoice or Supplier PO. Prefixes such as 'PO:' are optional.